Diet Soda Consumption by Country

Report Overview

The global diet soft drinks market size was valued at USD 4.1 billion in 2018. Demand for diet drinks has witnessed significant growth in the recent years on account of shifting consumer food habits towards healthier alternatives to high calorie beverages. Growing concerns over obesity and wellness have resulted in a shift in consumer preference towards diet beverages, thereby impacting market growth.

The two major companies: PepsiCo and Coca Cola have been focusing on introducing healthy and low sugar content soft drinks with an aim to gain a larger share in the market. These companies have introduced diet versions of their soft drink products in different flavors to tap the health conscious consumers. For instance, Coca Cola had launched Diet Coke in different flavors and no sugar beverages in the untapped smaller markets such as New Zealand. For instance, Keurig Dr Pepper, Inc. offers a large variety of diet soft drinks such as Canada Dry diet ginger ale, Sunkist Soda in diet orange flavor, and Diet Rite to name a few. Similarly, Schweppes offers diet tonic water, which is consumed as a soft drink.

The global diet soft drinks market is primarily driven by spurring demand for diet carbonated soft drinks, such as Pepsi and Coke. The companies have stepped up the production of their low sugar soft drinks as the demand spurts up during summer in India. Due to surging demand and shortage of diet coke and Pepsi, imported low sugar colas have been introduced in the retail outlets. The companies have been working on introducing diet versions of Thums Up and Sprite to cater to the large customer base who are shifting to low sugar level soft drinks.

Surging demand for diet versions of soft drinks as an accompaniment for food, especially in the food services industry, is expected to ramp up the production of these products. Moreover, growth of clean and healthy eating trend has impacted the growth of the food and beverage industry, wherein the manufacturers are focusing on developing products with minimal or no artificial additives. For instance, in Argentina, Coke had launched Coke Life, which has stevia as a primary sweetener. PepsiCo has been offering Pepsi Next, a low calorie soft drink with stevia in France and Australia.

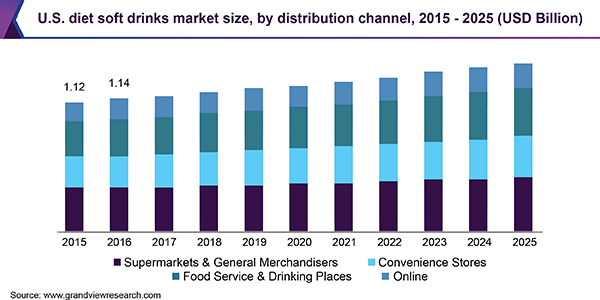

Distribution Channel Insights

Diet soft drinks are significantly purchased from the supermarkets and general merchandisers. The revenue generated from supermarkets was USD 1.4 billion in 2018. The physical display of products in the stores allows customers to scan product details. Moreover, availability of a wide range of products offered by different brands enables consumers to compare and choose the best product. Development in the organized retail sector and various offers and discounts provided by the leading players have also helped in increasing the visibility of these products.

In addition, the products are bought through online distribution channels. This category is anticipated to expand at the fastest CAGR of 3.8% from 2019 to 2025. Increasing e-commerce platforms and growing usage of smartphone in daily life is driving the online distribution channel. Companies like bigbasket.com and groffers.com are coming up with door-to-door delivery of products with online display of a wide range of products. Moreover, the coupon offers provided by the online platforms are influencing the buying behavior of the customers.

Regional Insights

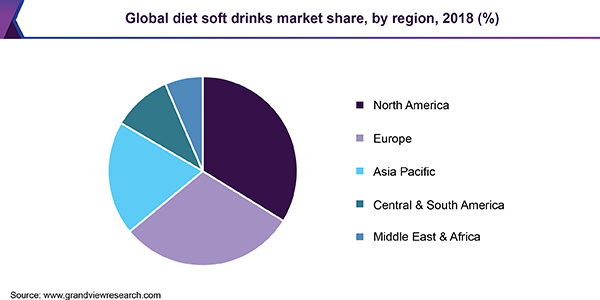

North America dominated the market with a revenue of USD 1.4 billion in 2018. This is on account of huge consumption of drinks in daily life among customers of the age group of 15-20 years in U.S. In addition, new companies are acquiring new segments of the market with their premium products, including unique flavors in drinks with health and nutritional benefits, in order to target customers with greater buying power.

Asia Pacific is expected to be the fastest growing market with a CAGR of 3.8% from 2019 to 2025. The market in Asia Pacific has good opportunity for new segments, such as convenience food and non-alcoholic beverages, as developing countries including India are adopting western culture and lifestyle, which enables consumers to be health conscious in daily life. Moreover, growing working women population is making women economically independent, thus creating an opportunity for convenience food and beverage products. These factors are anticipated to boost the demand for diet soft drinks in the coming years.

Key Companies & Market Share Insights

The global market is fragmented in nature owing to the presence of major players including Coca Cola; PepsiCo; Keurig Dr Pepper, Inc.; Nestlé; Unilever; Cott Corporation; and Polar Beverages. The companies are adopting market strategies of developing new products according to the latest consumer preferences for health benefits in order to acquire a larger market share. Thus, it is expected to increase the demand for diet soft drinks in the coming years.

Diet Soft Drinks Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 4.39 billion |

| Revenue forecast in 2025 | USD 5.17 billion |

| Growth Rate | CAGR of 3.2% from 2019 to 2025 |

| Base year for estimation | 2018 |

| Historical data | 2015 - 2017 |

| Forecast period | 2019 - 2025 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2019 to 2025 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Distribution channel, region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; U.K.; Germany; Australia; India; Brazil |

| Key companies profiled | The Coca-Cola Company; PepsiCo, Inc.; Keurig Dr Pepper, Inc.; Nestlé; Unilever; Cott Corporation; Polar Beverages |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global diet soft drinks market report on the basis of distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Supermarkets & General Merchandisers

-

Convenience Store

-

Food Service & Drinking Places

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global diet soft drinks market size was estimated at USD 4.25 billion in 2019 and is expected to reach USD 4.39 billion in 2020.

b. The global diet soft drinks market is expected to grow at a compound annual growth rate of 3.2% from 2019 to 2025 to reach USD 5.17 billion by 2025.

b. North America dominated the diet soft drinks market with a share of 33.9% in 2019. This is attributed to huge consumption of drinks in daily life among customers of the age group of 15-20 years in the U.S.

b. Some key players operating in the diet soft drinks market include The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper, Inc., Nestlé, Unilever, Cott Corporation, and Polar Beverages.

b. Key factors that are driving the market growth include growing concerns over obesity and wellness, and introduction of healthy and low-sugar soft drinks by brands such as Pepsi and Coca-Cola.

Diet Soda Consumption by Country

Source: https://www.grandviewresearch.com/industry-analysis/diet-soft-drinks-market

0 Response to "Diet Soda Consumption by Country"

Post a Comment